Illustration by OpenAI

Use this checklist to make the most of 2026 FEHB Open Season

From rising premiums to fewer plan choices, this guide walks you through reviewing benefits, checking provider networks and using tax-advantaged accounts to keep your healthcare costs in check next year.

Welcome to the start of FEHB Open Season. It’s more important than ever to review your options because federal employees will face higher premiums in most plans, fewer choices, and changes to benefits next year. This checklist will guide you through the process of evaluating your current plan, finding a new plan, and saving on healthcare costs in 2026.

Check Which Plans are Available

FEHB will offer fewer choices in 2026, dropping from 146 plans to just 132. Most of the plans exiting the program are local, including:

- Aetna Open Access High (leaving GA, AZ, and PA)

- AvMed HDHP and Standard

- Independent Health High

- Priority Health High, Standard, and Value

- Sentara Health HDHP and High

One nationwide carrier is also leaving FEHB; the National Association of Letter Carriers (NALC) will no longer offer their CDHP and High Option plans. However, they’ll still be available through PSHB for USPS employees and annuitants.

If your current plan is discontinued, you should receive a notice from your carrier. Important: If you don’t actively choose a new plan during Open Season, you’ll be automatically enrolled in GEHA High.

There are only a couple new plans in FEHB for 2026:

- Kaiser is introducing a Prosper plan in the Fresno, CA, market.

- Baylor Scott & White is adding a Value plan in select Texas markets.

Review Section 2 of the FEHB Plan Brochure

Your current FEHB plan may look different in 2026. Premiums will increase for most, and changes to plan benefits may impact your out-of-pocket costs.

To see exactly what’s changing, go straight to Section 2: “Changes for 2026” in your plan’s official brochure. This section outlines all major updates, including:

- New or discontinued benefits

- Adjustments to cost-sharing (like copays and coinsurance)

- Changes in pre-authorization requirements

You can find the plan brochure on the carrier website, on OPM’s plan comparison tool, and on Checkbook’s Guide to Health Plans.

Here are examples of some 2026 changes:

- The catastrophic limit will increase in 29 FEHB plans.

- Qualchoice and Kaiser Colorado plans are adding doula coverage.

- BCBS Basic will raise the member cost share for durable medical equipment, inpatient and outpatient hospital, and brand-name prescription drugs.

- GEHA Standard will increase the deductible, primary care and specialist copay, and the coinsurance percentage for many other benefits.

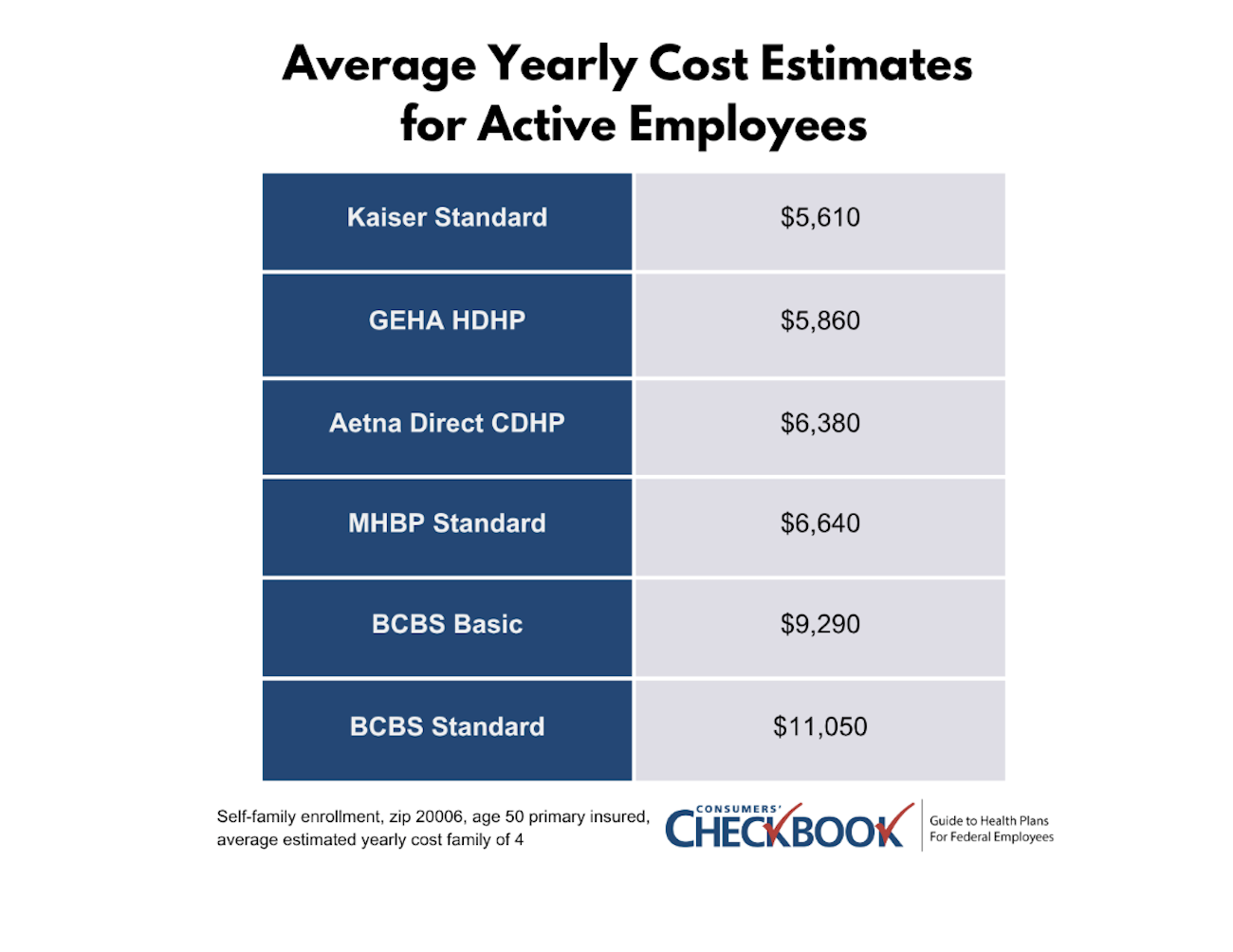

Use Yearly Cost Estimates to Narrow Down Plans

What you’ll pay for healthcare next year goes beyond just your plan’s premium. While it is an important factor, the premium alone doesn’t include what you'll pay when you use healthcare services, or whether the plan contributes to a savings account (more on that below), which can significantly offset costs.

For 47 years, Checkbook’s Guide to Health Plans has ranked plans on estimated yearly cost: the combination of premium plus likely out-of-pocket costs based on your information. This benchmark ranking shows big cost differences.

For example, a family of four in the Washington, D.C., area with a 50-year-old primary insured and average healthcare expenses could save $5,190 in estimated costs switching from BCBS Standard to GEHA HDHP.

Check Providers and Prescription Drug Coverage

If you have existing healthcare providers, verify how they’re covered under the plan. You’ll always pay less staying in-network, and you can’t assume that the same providers will be included from one year to the next. For example, in August UnitedHealthcare and Johns Hopkins failed to reach an agreement, changing Johns Hopkins providers to out-of-network for UnitedHealthcare’s FEHB plans and other FEHB plans that use a UnitedHealthcare provider network.

You can check the status of your current doctors by using the provider directory lookup feature on your FEHB plan’s website, and you can also contact your providers directly to make sure they will be in-network.

While reviewing your FEHB plan online, take a moment to check how your prescription medications will be covered in the upcoming year. Many plans have online drug cost tools where you can enter the medication name, dosage, and preferred pharmacy to see detailed coverage and pricing information. Just like provider networks, drug coverage can change annually, and checking now can help you avoid a surprise next year.

Take Advantage of Tax Preferred Savings Accounts

With a 12.3% average increase in the enrollee share of FEHB premiums for 2026, federal employees should be looking for ways to save money on healthcare expenses. Only about 20% of federal employees use a Flexible Spending Account (FSA) even though everyone will have some predictable healthcare expenses each year, from dental or vision care to prescription drug refills and over-the-counter pharmacy items. An FSA is funded through payroll contributions, lowering your taxable income and producing savings of around 30% for eligible healthcare expenses. The contribution limit will increase slightly next year to $3,400 but be aware that only $680 of unused funds can be rolled over. The FSA program shares the same Open Season dates as FEHB, and you can learn more at FSAFEDS.

HSAs offered by High Deductible Health Plans (HDHPs) offer federal employees an even greater opportunity to save for both immediate and future healthcare expenses. HSA contribution limits are increasing in 2026 to $4,400 for self-only enrollees and $8,750 for self-plus-one and self & family enrollments. HDHPs fund the HSA with a monthly premium pass-through that varies by the plan and ranges from $750 to $1,200 for self-only enrollees and $1,500 for $2,400 for self-plus-one and self & family enrollments. Any voluntary contributions that you make on top of the plan contribution are triple-tax-advantaged: they go in tax-free, grow tax-free, and, if withdrawn for a qualified healthcare expense, exit tax-free. You can make non-medical distributions from the HSA, but before the age of 65 you would have to pay both your normal tax obligations and a 20% penalty for those, after you turn 65 the penalty goes away. Employees with an HSA aren’t allowed to have a general-purpose medical FSA, but they can still set up a limited expense FSA for dental and vision expenses. Using this resource for those expenses increases the likelihood of your HSA funds staying invested and growing over time.

Once you retire and begin receiving an annuity, you'll no longer be eligible to participate in the FSA program. Additionally, once you enroll in Medicare, you’ll lose eligibility to receive an HSA from an HDHP, and you’ll no longer be able to make voluntary contributions to an existing HSA.

The Final Word

Even if you’re satisfied with your current health plan and inclined to keep it, there could be significant changes in the premium, out-of-pocket costs, access to providers, or prescription drug coverage that may no longer make it the best choice for you.

Make sure to review the following: how your plan’s premium is changing, section 2 of the official plan brochure for important benefit changes, and the online provider directory and prescription drug pricing tool to see if your doctors will remain in-network and that there aren’t significant cost or coverage changes to any prescription drugs you may take.

Those looking to save money can consider switching plans to one with a lower estimated yearly cost, which might be an HDHP with an HSA, and remember to enroll in an FSA to save around 30% on qualified healthcare expenses.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s 2026 Guide to Health Plans for Federal Employees is available now. Check here to see if your agency provides free access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.