While they have fewer options than federal employees to offset health insurance costs, federal annuitants can still deploy some cost-savings strategies. Raja J / Getty Images

Open Season advice for annuitants

Federal annuitants often don't have the same flexibility as federal employees when it comes to offsetting their health insurance costs, making it important to keep certain strategies in mind when weighing Open Season enrollment.

Federal annuitants face two significant premium increases next year:

- FEHB premiums will rise by an average of 12.3% for the enrollee share.

- Medicare Part B premiums will increase by 9.67%.

Unlike active federal employees, annuitants have fewer options to offset these costs. They lose the ability to pay FEHB premiums with pre-tax dollars and cannot participate in tax-advantaged programs like Flexible Spending Accounts or Health Savings Accounts (HSA contributions end once you enroll in any part of Medicare).

The good news: There are still strategies to help reduce health care expenses. In this article, I’ll highlight key changes for the upcoming year and share practical tips to help annuitants save money.

Increased costs for Medicare next year

The Centers for Medicare & Medicaid Services (CMS) has finalized Medicare costs for 2026, and annuitants should prepare for higher expenses:

- Part B premium will rise from $185/month to $202.90/month.

- Part B deductible will increase by $26, bringing it to $283/year.

Your 2026 Part B premium is based on your income, specifically the Modified Adjusted Gross Income (MAGI) reported on your 2024 tax return.

For 2026:

- Individual tax filers with MAGI of $109,000 or less and joint tax filers with MAGI of $218,000 or less will pay only the standard Part B premium.

- Higher incomes trigger an Income-Related Monthly Adjustment Amount (IRMAA) surcharge. In the first IRMAA tier, your total costs for Part B will increase $81.20/month.

IRMAA also applies to Medicare Part D, but the surcharge is much smaller, just $14.50/month in the first tier.

Finding an FEHB plan that waives some costs with Medicare

Switching plans remains one of the most effective ways for federal annuitants to save on health care costs next year. If you have Medicare Parts A and B, look for an FEHB plan that waives out-of-pocket costs when Medicare is primary. Not all plans offer this benefit, so it’s important to check.

To confirm how your plan coordinates with Medicare, review Section 9 of the official FEHB plan brochure. This section clearly states whether the plan waives costs when Medicare is primary.

Examples of FEHB plans that waive costs with Medicare:

- Aetna Direct CDHP

- BCBS Basic

- BCBS Standard

- GEHA High

- GEHA Standard

…and many others.

If your current FEHB plan does not waive costs when Medicare is primary, which is the case with plans including APWU CDHP, Compass Rose Standard, GEHA Elevate and others, you may want to consider switching. Doing so ensures you get some value for paying a second premium.

Consider Medicare Advantage plans from FEHB carriers

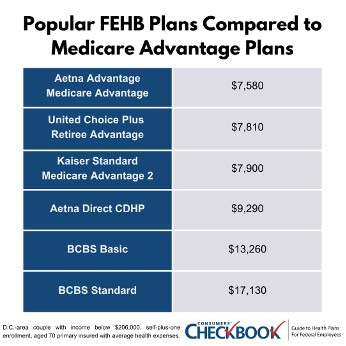

In recent years, many FEHB carriers have introduced Medicare Advantage (MA) plans and these can offer substantial savings for annuitants. Most MA plans waive out-of-pocket costs for nearly all health care services when you use providers that accept both Medicare and the plan, leaving prescription drugs as the primary remaining expense.

Additionally, MA plans often include partial Part B premium reimbursement, which is typically higher than what any non-MA FEHB plan offers. Combined with lower FEHB premiums, these features can result in significant savings compared to popular FEHB options.

For 47 years, Checkbook’s Guide to Health Plans has ranked plans on estimated yearly cost: the combination of premium plus likely out-of-pocket costs based on your information. Depending on your current FEHB plan, a married couple enrolled as self plus one with Medicare Parts A and B living in the Washington, D.C., area with income below $218,000/year could save thousands switching to an MA plan.

While MA plans will save most annuitants money compared to their current FEHB plan, it may not be the right plan type for everyone. The provider network could be different compared to your current FEHB plan. You’ll want to check if your providers are covered before enrolling. Also, there could be more prior authorization requirements with MA plans compared to FEHB plans, which could lead to either delayed or denied care.

How Part D can save you money

Several FEHB plans offer Part D prescription drug coverage to Medicare beneficiaries. To be approved by OPM, the Part D plans must provide prescription drug coverage that is equal to or better than prescription drug coverage from the FEHB plan. To see if you’ll benefit from Part D coverage, you can go to the carrier website to find the prescription drug cost tools where you can enter your medication, dosage and preferred pharmacy to see if your drug is covered and what the price will be. In our analysis, on many occasions, the out-of-pocket cost is lower with Part D, compared to FEHB plan coverage. In addition, all Part D plans will have a $2,100 out-of-pocket limit for covered drugs next year.

There are 20 FEHB plans that offer Part D coverage:

Aetna: Direct CDHP, Open Access Basic & High (D.C., Maryland and Virginia)

APWU: High

BCBS: Basic, Standard

Compass Rose: High

Foreign Service

GEHA: High, Standard

HealthPartners: High, Standard

Kaiser (Washington Core): High, Standard, Prosper

MHBP: Consumer Option, Standard, Value

SAMBA: High, Standard

Medicare beneficiaries enrolled in one of the plans will be automatically enrolled in Part D, if they haven’t disenrolled from Part D in the past. Your plan will notify you if you’ve been auto-enrolled and you retain the right to disenroll and stick with prescription drug coverage from your FEHB plan (Part D works differently with PSHB plans).

While Part D coverage will benefit most federal annuitants, there are some scenarios where it may not be the right choice.

- Overseas coverage: Part D does not pay for overseas prescription drugs. Those living permanently overseas will want to stick with FEHB coverage. Those travelling overseas should consider travel insurance that reimburses for health care expenses not covered by insurance.

- Pharmaceutical discount coupons: You lose access to coupons when enrolled in Part D. If you take advantage of these, you’ll need to weigh their benefit against the benefits of Part D.

- Part D IRMAA: While there is no extra premium for Part D coverage, Medicare beneficiaries with high income may be subject to Part D IRMAA. Individual tax filers with income above $109,000 and joint filers with income above $218,000 will be subject to Part D IRMAA. In the first IRMAA income tier this will be $14.50/month. If you don’t have prescription drug needs, you’ll want to disenroll from Part D. You can reenroll in the future and will not be subject to any Part D late enrollment penalties as all FEHB plans have creditable prescription drug coverage.

The final word

With FEHB and Medicare Part B premium increases, most annuitants will see higher health care expenses next year. However, there are still ways to save money. Finding an FEHB plan that eliminates out-of-pocket costs and considering whether Medicare Advantage plans might work for you will be two important ways to do that. For annuitants who have prescription drug needs, evaluating Part D coverage could lead to out-of-pocket cost savings as well as protection against having to pay more than $2,100/year for covered drugs next year.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s 2026 Guide to Health Plans for Federal Employees is available now. Check here to see if your agency provides free access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.

NEXT STORY: IRS hastens backpay timeline after union outcry