Illustration by OpenAI

What FEHB changes mean for your 2026 health coverage

Premiums are shifting, and the government contribution varies. Here’s what to know to avoid surprises and save where you can.

Most federal employees and retirees will pay much more for health coverage next year; the enrollee share of premium is going up 12.3% on average. OPM cites an aging federal workforce with more chronic conditions and prescription drug usage, including GLP-1 medications prescribed for weight loss, as contributors to the premium increase.

How will this impact you this Open Season? I’ll go through premium changes in popular plans, discuss which ones saw their costs go up above and below the average, provide enrollment advice for two-person families, explain the government premium contribution, and cover what to expect from FEDVIP options.

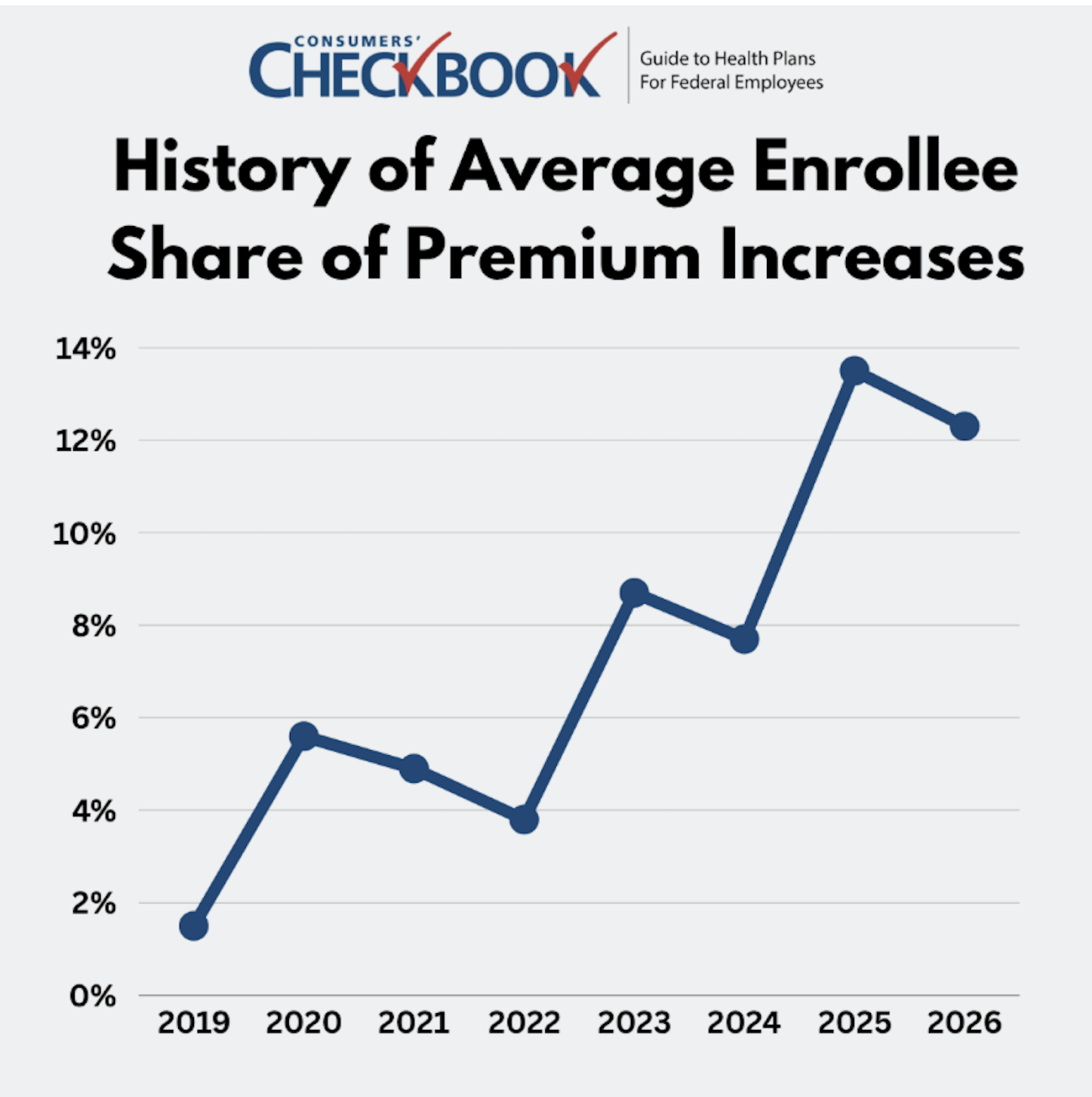

Recent History of FEHB Premium Increases

Next year's premium hike is slightly lower than 2025’s, but it marks the second straight year of double-digit increases. Just four years ago, the average enrollee increase was only 3.8%. Federal employees and annuitants should anticipate continued large premium increases in the future.

How FEHB Premiums are Changing in 2026

While the average enrollee share of premium is going up, not all plans reflect that trend. For the 129 FEHB plans available

in 2025 and 2026, self-only premiums will decrease in 23 plans, increase below the 12.3% average in 57 plans, and increase above the average in 49 plans.

Some of the changes are striking: The largest decrease in enrollee share is 18% for Kaiser Permanente High (F81), available in Georgia, saving enrollees approximately $727 next year. On the other end of the spectrum, the largest percentage increase affects a small group: the Panama Canal Benefit Plan (431), which is limited to employees working in the Panama Canal Zone. That plan’s premium is rising by a staggering 139%, costing enrollees an additional $4,622. The next highest increase is 99% for UnitedHealthcare Choice Plus Primary (WF1), available in parts of Arizona, Nevada, Oregon, and Washington, adding about $2,330 to the annual cost.

How is your plan’s premium changing next year? Even if you’re happy with your existing coverage, it will likely be more expensive. Not all premiums increased at the same rate, and there may be a new plan that’s of better value, which is why it’s important to know how this for-sure expense will impact your budget next year.

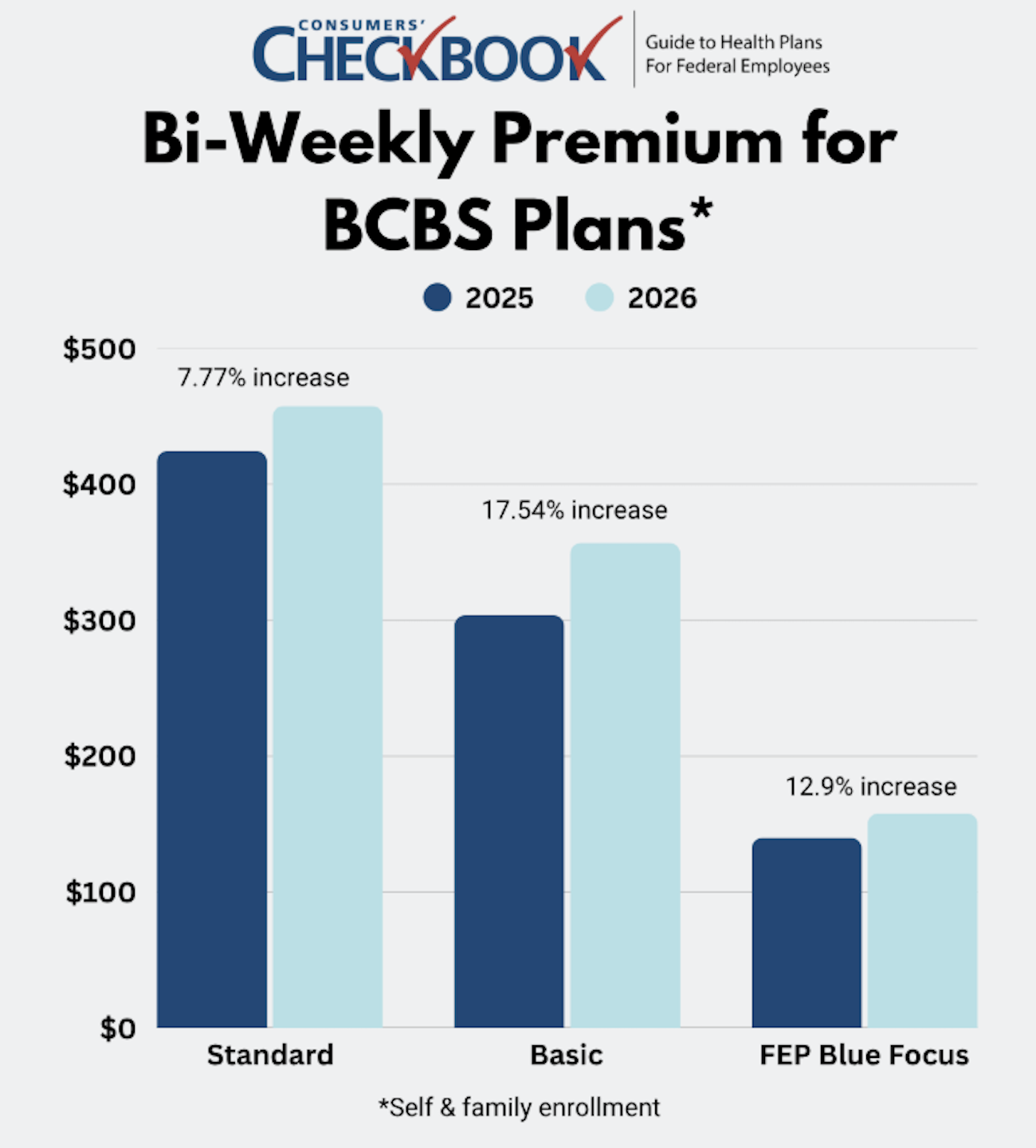

Blue Cross Blue Shield

About two-thirds of federal employees are enrolled in one of the Blue Cross Blue Shield (BCBS) plans: Standard, Basic, or FEP Blue Focus.

Standard increased below the all-plan average, while Basic and FEP Blue Focus went up more.

If you’re currently enrolled in a BCBS plan, when was the last time you evaluated the other two options to compare benefit and cost differences? This upcoming Open Season is a good opportunity to assess whether your current plan is still the best fit for your needs.

There are many differences between Standard, Basic, and FEP Blue Focus, but some of the most significant are that Standard is the only plan where:

- You can see out-of-network providers,

- Receive mail-order prescription drugs (Basic has mail-order prescription drug coverage only for annuitants with Part B),

- Obtain skilled nursing care benefits,

- And receive IVF coverage, up to $25,000 annually.

If you’re enrolled in Standard and don’t use those benefits, you could save some serious money switching to Basic or FEP Blue Focus, and you’ll get to keep your existing BCBS in-network providers. Families switching from Standard to Basic would save $2,621 next year, and families switching from Standard to FEP Blue Focus would save $7,792.

Self-Plus-One vs Self-&-Family Enrollment

Married couples and two-person families can enroll as self-plus-one or self-&-family. Most of the time, self-plus-one is the cheaper choice, but there are 39 FEHB plans where self-&-family enrollment is less expensive, and nine plans where the premiums are the same.

There’s a lot of money at stake based on your enrollment decision. For example, a two-person family considering the D.C.-area Kaiser High (E3) plan can save $66.86 bi-weekly enrolling as self-&-family compared to self-plus-one. That adds up to $1,738 annually.

You can find premiums by going to the last page of the plan’s official FEHB brochure. Look for the enrollee share of premium and choose the enrollment option that’s cheaper. You’ll receive the same benefits regardless of enrollment type.

Government Share of Premium

What the government pays toward your health insurance varies by plan. You’ll either receive 72% of the weighted average for all plans based on your enrollment type, or 75% of the total premium for the plan you select, whichever is less. This means that for lower-cost plans, you may receive the full 75% contribution, but for higher-cost plans, the government share may fall well below that.

Looking at self-only enrollment for 2026, 66 out of the 132 available plans will receive the 75% maximum government contribution. This includes BCBS FEP Blue Focus, GEHA Standard, MHBP Standard, Aetna Advantage, UnitedHealthcare Choice Primary, several Kaiser plans, and many others.

On the other hand, if you’re enrolled in a high-premium plan, the government’s contribution might not even cover half of the total premium. Self-only enrollees in Aetna Open Access High Option (JR1) available in Northern New Jersey have such a high premium that the government’s weighted average contribution only covers 27%.

FEDVIP Premiums

FEDVIP premiums have historically increased at a much lower rate compared to FEHB plans, and this remains true in 2026. Dental plan premiums will go up 3.3% on average, and vision plan premiums will increase by .5%.

The Final Word

FEHB premiums are rising an average of 12.3% in 2026, but many plans will see even steeper increases. While premium cost is just one factor in choosing a health plan, it’s a guaranteed expense that directly affects your budget. That’s why it’s essential to review how your current plan’s premium is changing and explore whether another option might offer better value for you and your family.

Looking to save money on your healthcare expenses next year? A smart starting point is looking for plans where the government pays 75% of the total premium. Make sure to check in-network providers, prescription drug coverage, and any unique benefits that matter to you before switching.

The 2026 FEHB Open Season runs from Nov. 10 to Dec. 8, giving you time to compare, evaluate and make the best choice for your needs.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s 2026 Guide to Health Plans for Federal Employees will be available on the first day of Open Season, Nov. 10. Check here to see if your agency provides free access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.