sommart / Getty Images

Is FEGLI Option B really the best life insurance choice?

FEGLI plans remain a solid life insurance option for federal employees, but, depending on the coverage, it may also be wise to look to the private market.

If you’re reading this article, you understand that life insurance is an important part of your financial plan. With that established, the task of finding the best life insurance option can be daunting. The further you look, the more types of insurance you’ll find, from simple term policies to complex whole and Universal Life varieties.

For many federal employees, the Federal Employees’ Group Life Insurance program offers a simple, straightforward way to secure life insurance. But is it really your best option?

While the Basic coverage is subsidized by the government and usually a great deal, FEGLI Option B (the optional additional coverage in multiples of your salary) deserves a closer look.

At younger ages, FEGLI B can be very affordable. But as you age, costs increase dramatically — often making private term life insurance the more cost-effective choice. Let’s compare.

How FEGLI B Costs Work

While FEGLI Basic is subsidized by the government and offers a stable premium regardless of age, FEGLI Option B charges premiums based on your age bracket. Every five years, the cost increases — and the jumps can be steep.

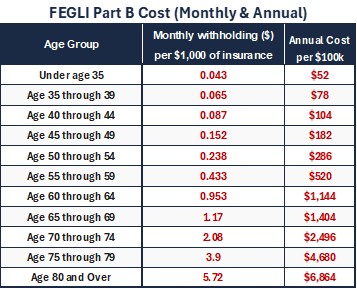

Here’s what the cost looks like per $100,000 of coverage:

Notice how coverage that costs just $51 a year in your early career skyrockets to over $1,000/yr at 60. And this is the cost per $100,000 of coverage. That means if you have a $150,000 salary at age 60, and you’ve maxed out the Part B with 5x coverage, you’d be paying nearly $8,600 per year on $750,000 of insurance.

Long-Term cost of holding FEGLI B

Because costs rise every five years, the cumulative expense of FEGLI Option B can be staggering if held for decades.

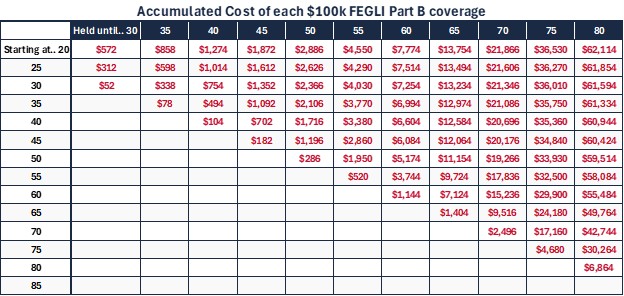

Here’s the total cost of $100,000 in coverage if you started at different ages and held it until age 65:

That means a 25-year-old who keeps just $100,000 of FEGLI B until retirement at 65 spends about $13,500 in total premiums. For someone needing $500,000 of coverage, that’s nearly $67,500 paid in.

Comparing to private term life insurance

Now let’s look at the alternative. Private term life insurance typically locks in a level premium for 20–30 years, meaning your cost stays flat throughout the policy term.

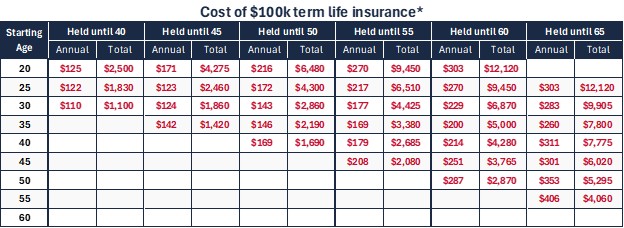

Here’s a look at comparable cumulative costs for a “standard” non-smoker buying $100,000 of term coverage (average quotes run in August 2025):

At age 40, a 25-year level term policy would cost around $7,775 total through age 65. Compare that to FEGLI’s $12,584 cumulative cost by age 65 — and the gap only widens after retirement.

Notice the numbers get more dramatic the older you are when FEGLI B starts, and the longer it’s held.

For someone who only needs insurance from ages 30-50, FEGLI B is likely the most cost-effective option. But if you need coverage into your 60s and beyond, private term insurance begins to look much better.

Additionally, there are several variables that could alter these numbers. For example, if you’re a tobacco user, or if you have a pre-existing health condition, your rates for private insurance may be higher than what’s shown. If you’re in very good health, they may be lower.

Key takeaways for federal employees

- FEGLI Basic = Usually a great deal. Keep it.

- FEGLI Option B = Good short-term, costly long-term. Fine for younger employees but gets expensive quickly.

- Private term = Predictable and potentially cheaper over time. Locking in rates early can save tens of thousands compared to FEGLI.

Final thoughts

FEGLI Option B is convenient and affordable early in your career, but the rising costs can erode its value over time. Many federal employees benefit from keeping Basic coverage while supplementing with a private term life policy if they wish to be covered into their 60s and beyond.

If you’d like help running the numbers for your own situation — including how much coverage makes sense and whether FEGLI B fits into your long-term plan — reach out.

Austin Costello, CFP® is an LPL Financial Planner with Capital Financial Planners. If you have questions about your insurance needs or any other federal-specific financial planning question, register for a complimentary checkup. For topics covered in even greater depth, see our YouTube page.

This material contains only general descriptions and is not a solicitation to sell any insurance product or security, nor is it intended as any financial or tax advice. For information about specific insurance needs or situations, contact your insurance agent. This article is intended to assist in educating you about insurance generally and not to provide personal service. They may not take into account your personal characteristics such as budget, assets, risk tolerance, family situation or activities which may affect the type of insurance that would be right for you. In addition, state insurance laws and insurance underwriting rules may affect available coverage and its costs. Guarantees are based on the claims paying ability of the issuing company. If you need more information or would like personal advice you should consult an insurance professional. You may also visit your state’s insurance department for more information.

NEXT STORY: All TSP funds were back in the black in August