Revocable Living Trusts allow federal employees to adjust as their financial situation changes, whether that's receiving a lump-sum TSP distribution, inheriting assets or restructuring investments in retirement. Westend61 / Getty Images

Estate planning through Revocable Living Trusts: A guide for retirees and government employees

Federal employees can deploy more flexibility in their retirement and estate planning, as well as potentially safeguard assets for their beneficiaries by considering the range of offerings provided by a living trust.

As you approach or enjoy retirement, protecting the wealth you've accumulated throughout your career becomes a top priority. You've spent decades in government service building up your Thrift Savings Plan account and pension benefits. Proper estate planning ensures your hard-earned assets transfer smoothly to your loved ones while minimizing taxes and protecting against potential creditors.

One of the most effective tools in modern estate planning is the Revocable Living Trust. This comprehensive approach to wealth transfer offers significant advantages over traditional wills, particularly for retirees who want to maintain control during their lifetime while providing maximum protection and flexibility for their beneficiaries.

Understanding Revocable Living Trusts

A Revocable Living Trust is a legal entity you create during your lifetime to hold and manage your assets. Unlike a will, which only takes effect after death, a living trust operates immediately and continues seamlessly through incapacity and death. The "revocable" nature means you retain complete control to modify, amend or dissolve the trust while you're alive and mentally competent.

For government employees and retirees, this flexibility is particularly valuable. You can adjust your trust as your financial situation changes, whether that's receiving a lump-sum TSP distribution, inheriting assets or restructuring investments in retirement. The trust adapts to your evolving needs without requiring complex legal procedures.

Key Benefits for Retirees

- Avoiding probate court: Perhaps the most immediate benefit of an RLT is avoiding the probate process entirely. This is an important difference between RLTs and wills, which do require probate.

Probate can be time-consuming, expensive and public, with court proceedings often lasting months or even years. For retirees with substantial assets accumulated over decades of work, probate fees can consume a significant portion of the estate. According to Trust & Will's 2024 Probate Study, the average probate process takes 20 months to complete, and probate costs typically range from 3% to 10% of the estate's total value.

Your TSP account, pension benefits, real estate and investment portfolios can all transfer directly through the trust without court intervention.

- Privacy protection: Unlike wills, which become public record through probate, trusts maintain complete privacy. Your family's financial affairs, the extent of your assets and your distribution decisions remain confidential. This privacy is especially important for government employees who may have accumulated substantial retirement benefits that they prefer to keep private.

- Incapacity planning: As we age, the possibility of cognitive decline or physical incapacity becomes a real concern. An RLT can include detailed provisions for successor trustees to step in and manage your affairs if you become unable to do so. This eliminates the need for court-appointed guardianship proceedings and ensures your financial affairs continue uninterrupted according to your specific instructions.

- Creditor protection for beneficiaries: Modern RLTs can include sophisticated sub-trust provisions that protect your children and other beneficiaries from creditors and divorcing spouses. Rather than receiving assets outright, beneficiaries can serve as trustees of their own sub-trusts, maintaining control while keeping assets protected from outside claims.

Advanced trust structures, including sub-trusts

Beyond the basic revocable living trust framework, more advanced planning structures can provide enhanced flexibility and protection for your beneficiaries.

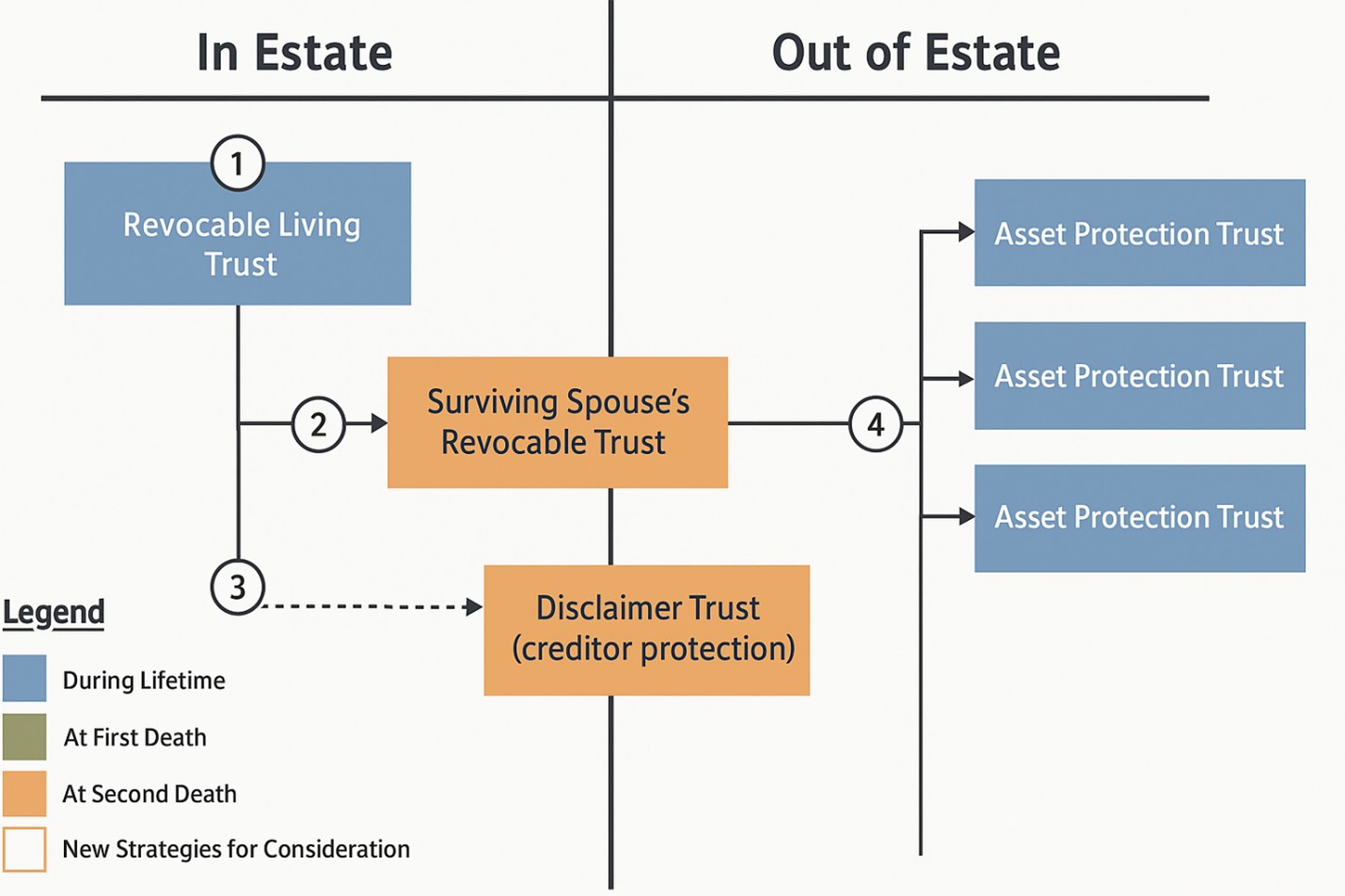

- Disclaimer trusts: Upon the death of the first spouse, assets typically transfer to the surviving spouse's revocable trust. However, the trust can include disclaimer provisions that offer additional flexibility. If circumstances warrant extra creditor protection or tax planning, the surviving spouse can disclaim assets, causing them to flow into an irrevocable disclaimer trust instead. This option provides post-death planning opportunities based on the actual financial and legal landscape at the time.

- Children's sub-trusts: After both spouses pass away, the trust divides into separate irrevocable asset protection trusts for each child. These sub-trusts serve multiple purposes: they protect assets from creditors and divorcing spouses while allowing children to act as their own trustees, maintaining practical control over their inheritance. This structure is particularly beneficial for government employees whose children may work in professions with higher liability exposure, such as healthcare or business ownership.

- Spendthrift clauses in sub-trusts: A spendthrift clause prevents beneficiaries from assigning their interest in the trust to creditors or from accessing large sums recklessly. Creditors cannot force distributions or claim trust assets before they are distributed to the beneficiary. This clause enhances asset protection for children in high-liability fields.

Below is an example of how the RLT is created and funded.

Additional features like co-trustees or trust protectors help manage assets during unforeseen circumstances, while lifetime distribution plans can offer ongoing protection and strategic estate planning benefits.

Tax considerations: GST vs. non-GST Trusts

When structuring trusts for the next generation, retirees face important tax decisions between Generation-Skipping Trust and Non-GST structures.

- Generation-Skipping Trusts protect assets from estate taxes across multiple generations. If your children have their own substantial estates and face potential estate tax liability, GST trusts ensure your wealth skips estate taxation at their death, preserving more for grandchildren. However, assets in GST trusts don't receive a stepped-up basis at your children's death, potentially increasing capital gains taxes when assets are eventually sold.

- Non-GST Trusts provide a stepped-up basis at each beneficiary's death, effectively eliminating capital gains taxes on appreciated assets. While these assets may be subject to estate taxes in your children's estates, the step-up in basis can provide significant tax savings if the assets have appreciated substantially.

Trusts are customizable so the choice between GST and non-GST structures isn't all-or-nothing. Your trust can create different structures for different children based on their individual circumstances. A child with substantial retirement accounts and real estate might benefit from GST treatment, while another child with modest assets might be better served by a non-GST trust.

Special considerations for retirement accounts

Government employees and other retirees with substantial qualified retirement accounts—TSP, 401(k), 403(b), and traditional IRAs—must pay special attention to trust language. These accounts require specific provisions to avoid accelerating income tax recognition and preserve the tax-deferred nature of retirement savings.

With the help of a financial professional to help understand the language, proper trust language ensures that when retirement accounts pass to trust beneficiaries, they can continue taking distributions over 10 years or their life expectancy rather than being forced to withdraw the entire balance within a few years. This preservation of tax deferral can represent hundreds of thousands of dollars in tax savings over time.

Implementation strategy

Creating an effective RLT requires more than just signing documents. The trust must be properly funded by transferring assets into the trust's name. Real estate deeds need updating, investment accounts require retitling and beneficiary designations on retirement accounts and life insurance policies should name the trust where appropriate.

For retirees, this process should be coordinated with existing estate planning documents and beneficiary elections made through employer benefits systems. Federal employees, for example, need to ensure their TSP beneficiary forms align with their overall trust strategy.

Take action to protect your legacy

Revocable Living Trusts offer retirees and government employees a comprehensive solution for protecting and transferring wealth while maintaining control and flexibility during their lifetime. The combination of probate avoidance, privacy protection, incapacity planning and sophisticated creditor protection makes RLTs particularly valuable for those who have accumulated substantial assets through decades of diligent saving and investing.

Successful trust-based estate planning requires proper structure and implementation. Collaborating with qualified professionals helps address tax implications and creditor protection, ensuring your trust meets your family's long-term needs.

Despite the clear benefits, estate planning adoption remains surprisingly low. According to Trust & Will's 2025 Estate Planning Report, only 31% of Americans have a will and just 11% have established a trust, leaving 55% of Americans with no estate plan at all. For government employees and retirees who have spent careers building substantial retirement benefits and assets, this lack of planning can be particularly costly for their families. A well-structured RLT provides that protection while preserving your family's privacy and providing flexibility to adapt to changing circumstances throughout retirement and beyond.

Please note that Capital Financial Planners is not a law firm and does not draft trusts, wills or other estate planning documents for clients. While we do advise on their benefits and can help outline strategies for our clients, an attorney in your state would need to draft the final documents.

Neil Cain and Austin Costello are certified financial planners with Capital Financial Planners. If you have questions about how retirement impacts your Medicare payments, register for a complimentary checkup. For topics covered in even greater depth, see our YouTube page.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.