Before enrolling in Medicare Part B, take a close look at how it fits with your FEHB coverage and long-term budget. designer491/Getty Images

Delaying Medicare Part B: Why the penalty isn’t always as bad as it sounds

For federal employees with FEHB coverage, the timing of Medicare Part B enrollment can make a bigger difference than the penalty itself.

If you’re a federal employee approaching retirement, you’ve probably heard mixed advice about whether to sign up for Medicare Part B at age 65. Many retirees with Federal Employees Health Benefits (FEHB) coverage look at the extra $2,000–$2,500 a year for Part B premiums and think, “Why pay for something I don’t really need yet?”

That’s a fair question. And for some, it can be a reasonable choice to wait. While Medicare does add a 10% penalty for every 12 months you delay, that penalty isn’t as punishing as it first appears. In some cases, waiting can actually make sense.

How the Medicare Part B Penalty Works

When you become eligible for Medicare at age 65, you have a seven-month window to sign up for Part B, which covers doctor visits, outpatient care, and other medical services not included in Part A.

If you delay enrolling and don’t qualify for a Special Enrollment Period, Medicare adds a 10% penalty to your monthly premium for every 12 months you delay. This “special” timeframe can be added if you’re still working and are covered by employer insurance.

This penalty is permanent, so as long as you have Part B, you’ll pay for it.

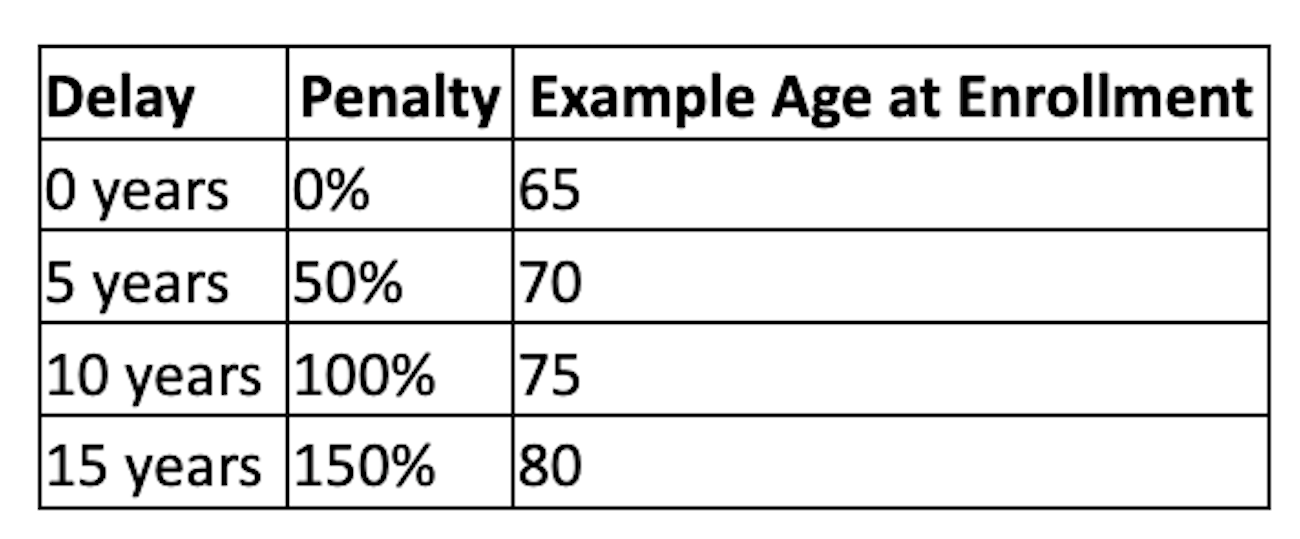

Here’s what that looks like:

If the standard Part B premium is $185 per month, a 50% penalty adds another $92.50 — bringing your total to $277.50 per month. At 100% penalty, you’d pay $370 a month. It’s not a small increase, but also not catastrophic either.

Why Some Federal Employees Choose to Wait

Many federal retirees stick with their FEHB coverage after 65 because it’s already strong. In fact, it’s one of the best employer health plans out there. If you’re healthy and don’t visit the doctor often, it’s understandable to think, “Why pay double for coverage I might not need yet?”

When you run the numbers, the penalty doesn’t keep snowballing forever. It actually flattens out, which means the financial hit of enrolling late isn’t as scary as people think.

What the Numbers Actually Look Like

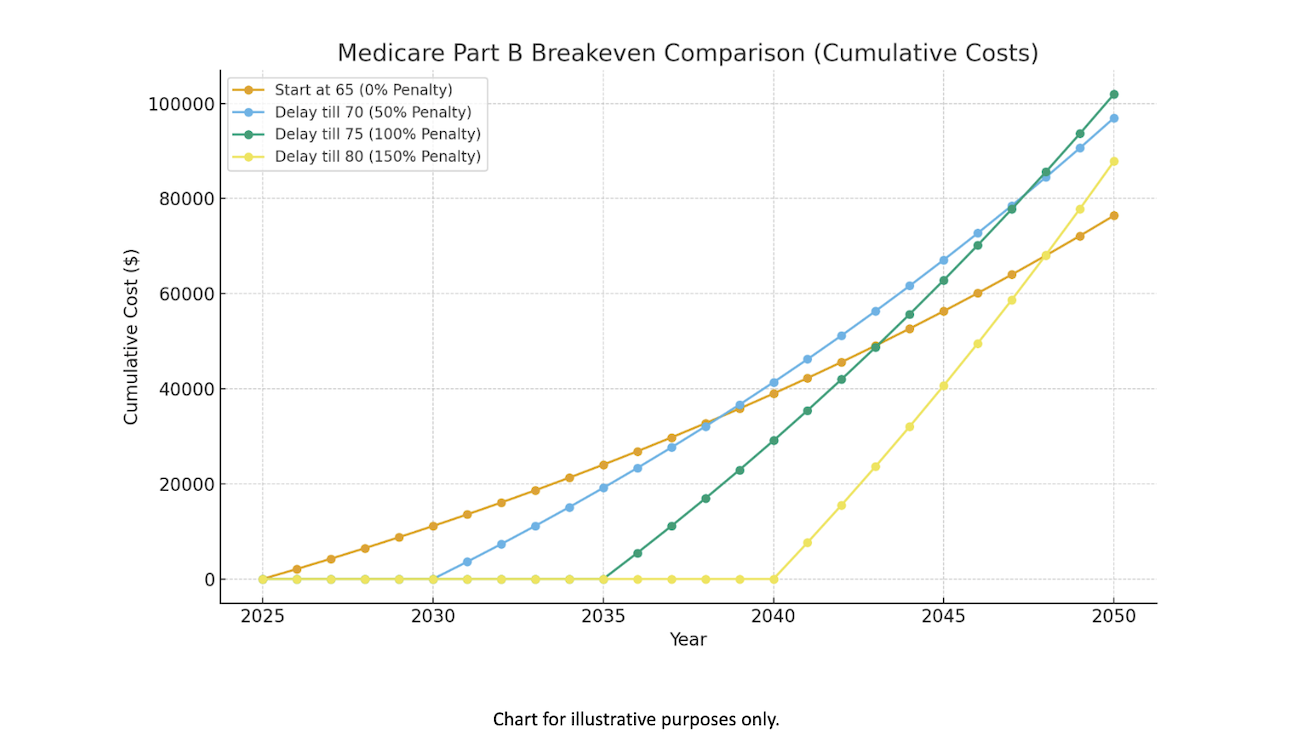

The following chart illustrates how total Medicare Part B premiums accumulate over time based on different enrollment ages. Individuals who begin coverage at 65 (orange line) start paying immediately and see steady annual growth in total cost. Those who delay enrollment to age 70, 75, or 80 (blue, green, and yellow lines) avoid paying early premiums but face higher monthly costs once they enroll due to the late-enrollment penalty.

At first glance, waiting looks expensive — and in the short term, it is. But notice what happens by age 80: the average annual cost drops. That’s because you’re paying a higher premium for fewer total years, and Medicare’s base premiums increase each year. Over time, the penalty becomes a smaller slice of the pie.

The “Bend Down” Effect: Why the Penalty Feels Worse Than It Is

The penalty may sound steep — 50%, 100%, 150% — but its real effect bends down as the years go on. Think of it like climbing a steep hill that levels out once you reach the top. Here are some reasons why:

- Premiums rise with inflation. Each year, the base Part B premium grows. Since your penalty is a percentage of that base, the relative difference between early and late enrollment gets smaller.

- You’re paying for fewer years. Someone who waits 15 years might pay more per month, but they’re only paying it for a decade or so.

- It’s a percentage, not a compound charge. The penalty doesn’t stack like credit card interest. It’s fixed — and over a long retirement, its bite fades.

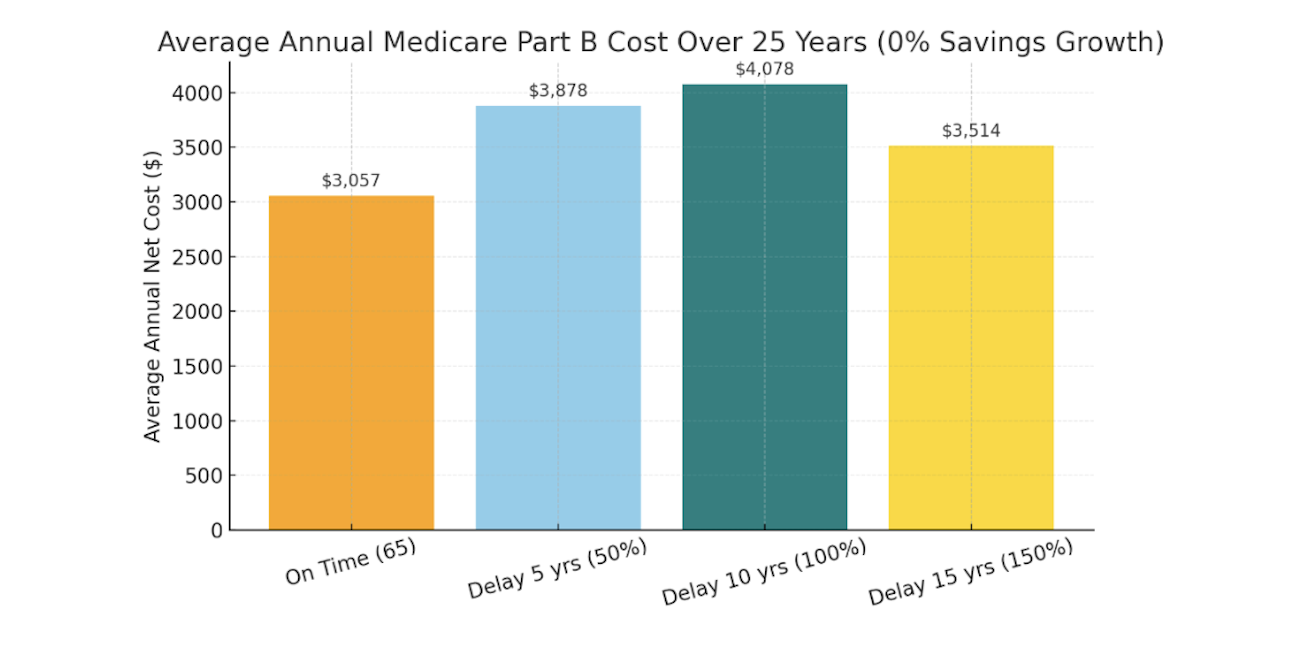

While the penalty may seem intimidating initially, over 20–25 years it becomes a modest, gradually flattening the expense.

So, Is it Ever Smart to Wait?

For some retirees, yes. Delaying Medicare Part B can be a strategic move, especially if:

- You’re still covered under FEHB and rarely see the doctor.

- You prefer to keep more cash flow early in retirement.

- You understand that you can always opt in later — with a manageable penalty.

It’s a bit like deciding when to refinance a mortgage: there’s no universal “right” moment, just what makes sense for your timeline and budget. So how should you decide?

Here are a few things to consider:

- Think about lifetime cash flow, not just next year’s premiums. Saving a few thousand now might make sense if you’re healthy — but if medical needs increase later, Medicare plus FEHB can dramatically lower out-of-pocket costs.

- FEHB and Medicare work great together. Many federal retirees who eventually enroll in both enjoy nearly full coverage and predictable monthly expenses. It’s a powerful combination.

- You can always come back, but timing matters. If you decide to join later, be aware of Medicare’s general enrollment periods. Missing them could delay your start date.

- Consider your spouse’s coverage. If your spouse isn’t a federal retiree, your decision might impact their insurance options as well.

Enroll on Time for Lasting Peace of Mind

Delaying Medicare Part B isn’t an irreversible mistake. It’s a trade-off. You might pay a little more later, but you’ll also save thousands in the meantime. And thanks to how the penalty “bends down” over time, the long-term difference is smaller than most people think.

If you’re on the fence, it’s okay to wait, but make sure you understand the numbers and have a plan to enroll before your health or coverage needs change. It’s not about avoiding risk entirely but managing it wisely.

If you need help understanding how enrolling on time fits into your retirement finances, a certified financial planner can walk you through the math and make sure you’re prepared for the years ahead.

Check out our YouTube video on: Medicare Part B: Should Federal Employees Sign Up or Wait?

Neil Cain is a certified financial planner with Capital Financial Planners. To discuss your investments, including your TSP, register for a complimentary Retirement Readiness Meeting. For topics covered in even greater depth, see our YouTube Channel.