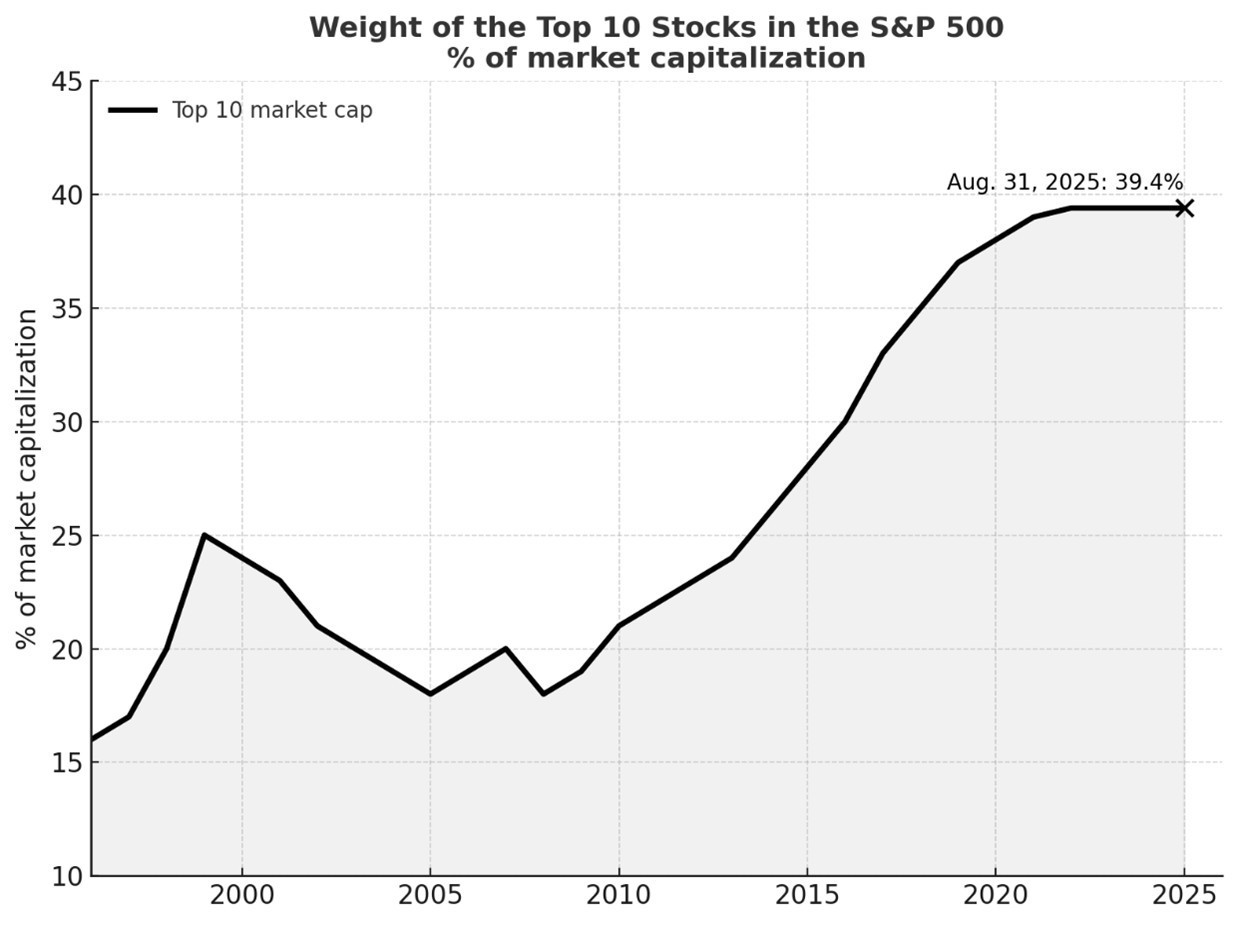

Today, the top 10 companies account for about 39% of the entire S&P 500 index. honglouwawa / Getty Images

When 500 companies don't equal diversification: A TSP reality check

Investing your TSP funds in the top 500 U.S. companies may seem safe and straightforward, but that depends on how those investments are weighted.

For many federal employees saving for retirement, the C Fund can be one of the most intriguing investments because it tracks the S&P 500 Index. At first glance, investing in the top 500 U.S. companies seems like a safe and straightforward way to build wealth for the future.

After all, these are household names that dominate headlines and drive the economy. We know these companies, so it’s easy to be drawn in by the reputation and apparent stability of giants like Apple, Microsoft and Berkshire Hathaway. However, the reality is more complicated. The shine of these big names can mask underlying risks, and just because an index includes hundreds of companies doesn’t mean your money is truly spread out.

Big names dominate the index

The S&P 500 is based on company size, which means the biggest companies, like the major firms mentioned above, get the largest portion of your investment. In other words, your money is mostly going to the giants, not invested equally among all 500 companies.

Today, the top 10 companies account for about 39% of the entire index. That means more than a third of your returns hinge on how this small group performs. While the S&P 500 includes a mix of sectors such as healthcare, energy and consumer goods, the influence of these few dominant companies often overshadows the performance of the other 490.

So, while it feels like you’re invested across the entire U.S. economy, your portfolio is riskier than you think because it’s really riding on the success, or failure, of a narrow slice of it.

Why most S&P 500 investments rely on a few big companies

To better understand the risk, imagine two different ways of constructing the S&P 500.

- Market-Cap Weighting (S&P 500’s method): Large companies like Apple make up a bigger portion of the index than smaller ones like Gap, giving them more influence.

- Equal Weighting: Every company gets the same representation, regardless of size. Apple and Gap would each represent 0.2% of the index.

Over time, using an equal-weighted approach—where each company in the S&P 500 has the same importance regardless of size—can create a more balanced portfolio. In some cases, it can even lead to stronger performance. That’s because smaller and mid-sized companies have more room to grow and contribute to returns, rather than being overshadowed by the largest firms.

In fact, the Financial Times reported that investors poured billions into equal-weight S&P 500 funds. This trend showed that more people are becoming uneasy with how much control a handful of mega-cap tech companies have over the market’s overall performance.

But the C Fund doesn’t work this way. Because it reflects the traditional market-cap weighted S&P 500, your investment is heavily concentrated in the largest names like Nvidia and Amazon. If those giants keep rising, your account grows quickly. But if they stumble, your fund’s value could drop sharply, even if hundreds of smaller companies in the index are doing just fine. In other words, the performance of just a few companies can disproportionately impact your retirement savings.

Why federal employees should pay attention

For federal workers relying on the Thrift Savings Plan to fund retirement, understanding these dynamics is critical. Some key points to keep in mind:

- Past performance doesn’t equal future security. The S&P 500 has delivered strong returns in recent years, largely because a handful of tech firms soared. But that doesn’t guarantee the same companies will drive future growth.

- Industry risk is real. With such a heavy tilt toward tech, the index is exposed if regulatory changes, earnings slowdowns or innovation cycles disrupt the sector.

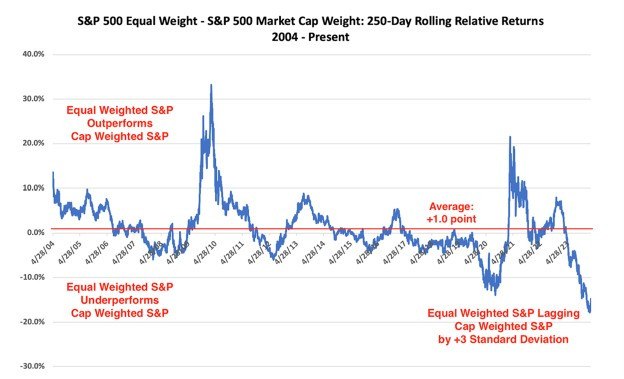

- Volatility works both ways. Concentration magnifies gains, but it also magnifies losses. A downturn in a few top names can drag the entire index down quickly, as seen in the chart below:

Balance matters

Over the past two decades, the balance of performance between the S&P 500 Equal-Weighted and Market-Cap-Weighted indices has revealed a powerful story about market concentration and investor behavior. While the equal-weighted version—where each company carries the same influence—has historically delivered about a one-point advantage on average, recent years have seen one of the most extreme divergences on record.

The equal-weighted index is now lagging its cap-weighted counterpart by roughly three standard deviations, underscoring how dependent today’s market has become on a handful of mega-cap stocks. This level of concentration may offer short-term strength but has often preceded periods when smaller and mid-sized companies regain leadership. For investors, the message is clear: diversification across company sizes and weighting styles can help balance the cycles of market dominance and opportunity.

Working with a certified financial planner can help you make informed decisions, ensuring your investment strategy is balanced and aligned with your personal timeline and goals. By diversifying across other TSP options and regularly reassessing your allocation, you can better protect your retirement savings and set yourself up for long-term success.

Check out our YouTube video on: The Hidden Risk in the TSP: Dangers in the C Fund

Neil Cain is a certified financial planner with Capital Financial Planners.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek guidance from an independent tax or legal professional. The content is derived from sources believed to be accurate. Neither the information presented, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Investing in mutual funds involves risk, including possible loss of principal. Fund value will fluctuate with market conditions and it may not achieve its investment objective.